An old friend is racked with fear and anxiety. A clinical OCD case like me, he obsesses about the family budget, which he recently took over. He’s obsessed about everything that could go wrong with him in control. I know exactly what he’s going through.

Mood music:

[spotify:track:0vIvLrpvGepwfvmUK7i66J]

Early in our marriage, Erin was chief budget keeper and bill payer. She insisted I try doing the bills so that I could get a better sense of what I was spending and how it fed into the bigger picture. I was scared shitless, and I made mistakes. I dreaded every morning.

Erin and I now have a system where I handle the finances for six months, then she does six months. She remains a far better budget keeper than me, but I have learned to pay the bills on time most of the time. Progress is progress.

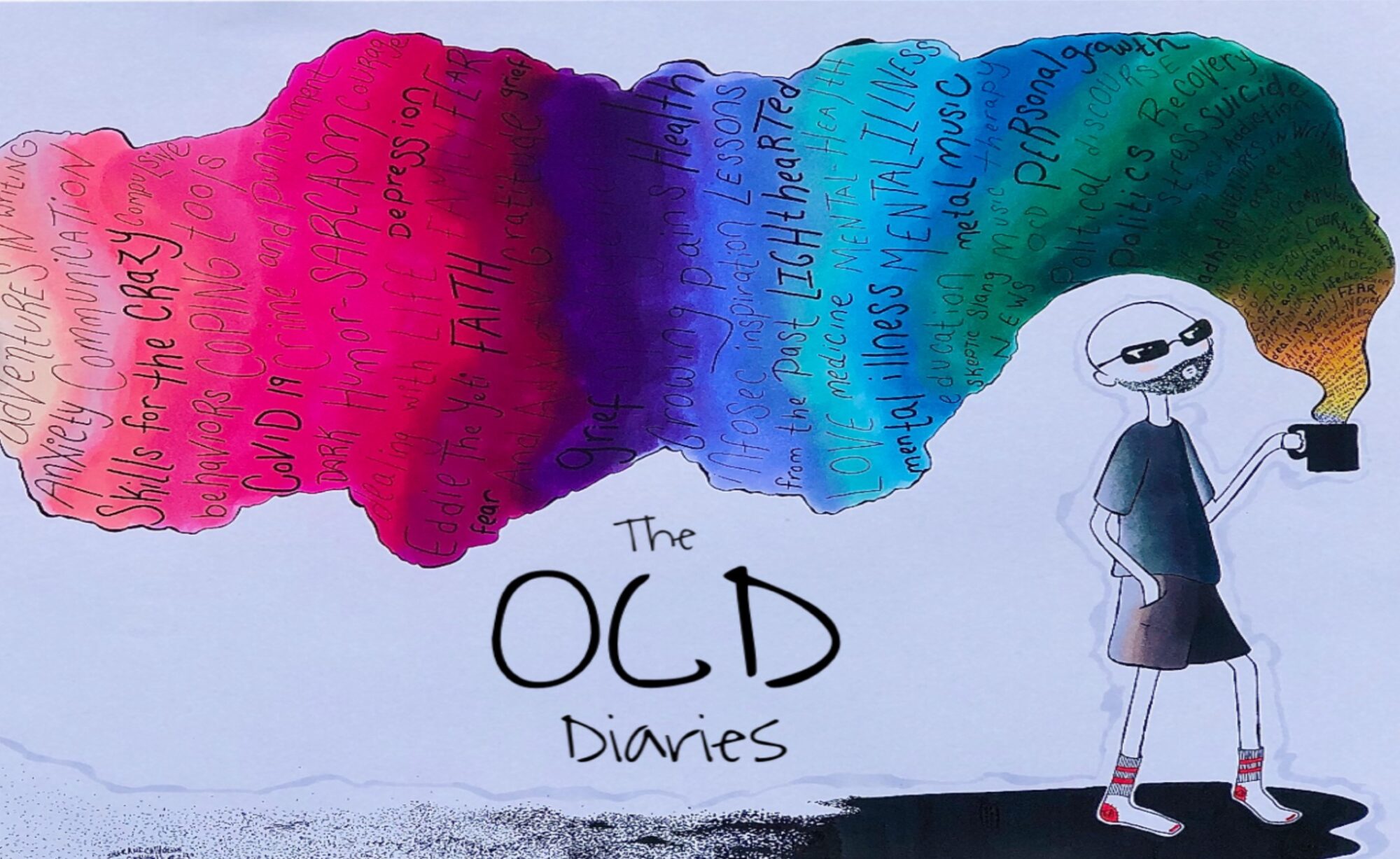

The treatment I’ve had to bring my OCD under control was a big factor in my progress. I still have daily OCD moments, but the fear and anxiety are gone.

Which brings me to a little exercise worth trying in fearful moments. This is mainly directed toward my friend and people in our mental situation. If you really are living in poverty and it’s not all in your head as it is for us, this won’t change things. But if you’re like us, maybe this will help.

- Remember that most people struggle with money. Even if you’re filthy rich, you struggle to manage all the money coming in and going out. If you’re middle class or lower, there’s never enough money. The budget is always out of alignment because life happens. Cars break down unexpectedly. Water heaters die at the most inconvenient time. Your situation is unremarkable. Remembering that will at least give you the comfort of not being alone.

- Ask yourself, what’s the worst that can happen? So you discover that you forgot to make the monthly car payment. What’s the worst that can happen? Will your car get repossessed? Unlikely, since you pay on time most of the time. You just fix the mistake by paying up and move on. Will you end up homeless because money is tight? You haven’t been tossed out up to this point and you’re financial situation is basically the same as always, so I doubt it. When we ask what’s the worst that can happen, we find that the worst isn’t so bad.

- Seek out people smarter than you. Worried that you don’t have enough to pay every bill on time and having trouble prioritizing? Get help. Find the smartest financial brain in the family and get their advice. They can help you prioritize and make the best of what you have to work with. Read up on finance basics (Erin recommends Get a Financial Life, a book she worked on.) Get a financial adviser to guide you along. We have an adviser, and he’s been very helpful when it comes to assessing the full financial picture and how to work with what you have. If you keep your concerns inside and don’t get help, you’re setting yourself up for trouble.

- Appreciate what you have. Money troubles may persist, but if you stop to remember what you have, things look a lot better. Your family still loves you. You still have your health and the ability to make positive changes in your life. Remember those things, take a deep breath and get back to the task.