Though I got rid of the fear-based anxiety that kept me indoors and afraid of everything, I still have moments when I get overwhelmed.

Mood music:

[spotify:track:2uKcU4FPX5eOjmd6RWb9OF]

Call it sensory overload or severe impatience, if you will. Or perhaps the latter two are mere byproducts of the first. Here are some examples:

- Long lines. Whether it’s waiting for a seat in a restaurant, for entry into a movie theater or for boarding a boat, long lines make me crazy inside.

- Traffic. When the highway becomes a parking lot, I feel claustrophobic. It’s worse when I’m surrounding by a lot of trucks, because they make it difficult to see what’s happening farther up the road.

- Housework. When there’s a lot of cleaning and fixing to do around the house, my brainwaves get scrambled and it becomes difficult to put the tasks in an order that makes sense. So I dart all over the place doing things haphazardly.

- Listening to long-winded people. This one seems mean, and I don’t mean for it to be. But when a person corners me for what turns into a long, long story, I start to scream inside. It makes me feel trapped and I feel like the rest of the world is passing me by.

- Long meetings. I’ll be honest and tell you that business meetings have never been a favorite of mine. True, they are necessary, but it always feels like I could be getting 10 other things done during that time. What really rattles me is when a meeting goes longer than scheduled. I start to fidget in my seat and lose the ability to hear anything anyone is saying.

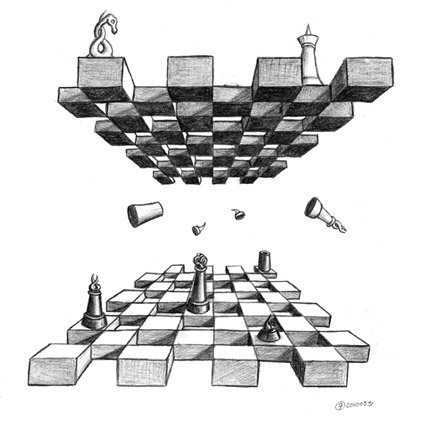

Now you’re probably asking yourself, “What does he do about all this?” The answer is not much. These are all things that are part of life. Avoiding them would mean I wouldn’t be living mine. I’d be a recluse, never achieving anything and missing out on a lot of good stuff.

So I put on my game face and trudge on.